The past year has dramatically emphasised the importance of asset managers building their offering to combine resilience and flexibility. At the same time, the Covid-19 pandemic has also put the focus on the complex marketing challenges asset managers face.

Firms that excelled showed the ability to improvise, evolve and serve clients in more innovative ways. Although continuing to get this right is vital, more change is needed to ensure success.

When marketing is thrown into the mix, the challenges to initiating and executing on transformative change are considerable. The aim of this blog is to encourage marketers to act and lead change.

Three Core Areas

Peregrine’s research identifies three core areas where asset managers should target their marketing resources. They are:

-

Differentiation & Relevance

-

ESG – Impact

-

Purpose, Culture & Talent

We believe that developing integrated campaigns focused on these channels offers marketers the opportunity to play a defining role in building asset management business success. In sum, addressing and executing successfully in these areas is an urgent priority and critical to continuing to move ahead.

Differentiation & Relevance

The proliferation of investment strategies and market opportunities make it essential for asset managers to embrace marketing to define their edge for distinct investor groups. Typically, managers have been more comfortable focusing on their investment track record, while assuming if they delivered business success would follow.

But if that was true at some point, it’s not the case anymore. What’s much more important is to know how to communicate and be transparent in the articulation of two closely-related things:

- A convincing and attractive market opportunity set that is related it to real world investor objectives;

- A multi-faceted definition of the manager’s investment edge that is backed up with fully grounded proof points and data.

Marketing has a significant role as it focuses on helping investment managers frame their proposition in these two critical areas. Indeed, we work regularly with investment fund clients to tackle just this problem, namely, of articulating the precise opportunity set a strategy is targeting and the manager’s differentiated-edge in delivering it.

“If all you do now is deliver outstanding performance, but can’t explain why or can’t explain the market conditions where you’ll shine or underperform, you’re not going to do well,” Amanda Tepper, founder and CEO of Chestnut Advisory Group, told Institutional Investor recently. “That’s where brand starts.”

It thus makes sense to focus on these things as a prerequisite to successful brand building. Strong differentiators can drive brand resonance and help a boutique player, for example, build a presence in a new geography even when competitors have more scale, a larger budget and better distribution.

There are also defensive benefits when marketing teams facilitate connected communication about differentiation, and use it to build advocacy and trust. Chief among them is the capacity that strong messaging and branding affords firms during times when, say, lacklustre performance makes it necessary to focus on projecting a credible account of a firm’s core qualities in response to investor or media enquiries.

ESG – Impact

Perhaps nothing in recent years has driven change in asset management more than ESG and impact investing. This has meant that early adopters and leaders in ESG investing face more competition from firms that are relative newcomers, including both niche players as well as the global giants.

In our second annual ESG report we looked at how asset managers could create stronger ESG content to drive investor engagement. The report looks closely at the logic of communicating social impact and how asset managers could do this more effectively.

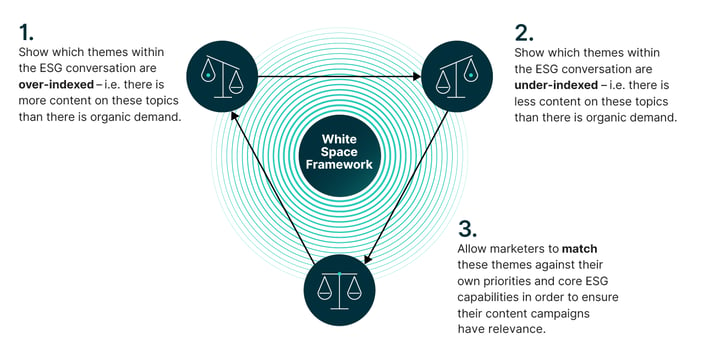

We advise firms to work out which subject areas they want to own and then do ‘white space’ analysis to find opportunities where there is demand for investor content and new thinking. Using this approach an asset manager can work out the most resonant themes to develop and to engage with investors. Key white space opportunities for ESG content that Peregrine identified included supply chain transparency, ETFs, activism, measurement and materiality, among others.

The good news for asset managers is that the rate of increase in search volumes for ESG – Impact thought leadership content continues to grow. This heightened demand is also evidenced in Tier 1 media with ESG and impact investing seeing accelerating growth in coverage. This combination provides an attractive backdrop for deploying content-led marketing and campaigns.

The challenge for asset managers who were innovators in developing ESG investing, but are now facing the concerted fire power of some relative newcomers, is how to maintain first mover advantage. One way to do this could be to get more specific about proposed investment impact using credibility developed in a broad ESG investment program to be leveraged into a thought leadership initiative on a particular issue, say, deforestation. Another tactic could be to become more forward looking, for example, outlining the next steps required to keep up progress toward reaching net zero.

Overall, the strategic relevance of ESG Impact programs to investors and other stakeholders can only grow. This makes it a big opportunity for marketers too.

Purpose, Culture & Talent

The third area for asset managers to focus marketing reflects the fact that demand for talent is intensifying. Yet managers are often sub-optimally positioned.

Perhaps the most troubling finding of our research is that interest and engagement levels with asset management brands continues to fall year-on-year. Our research into the Global 100 leading asset managers finds that nearly 6-in-10 (58%) saw no increase or a decline in their organic Google search volumes for a second year running.

This weakness in basic engagement finds an echo in data from the talent recruitment market. A Glassdoor survey published by CNBC found that for UK job seekers the top firms to work for tend to be in the tech space (led by Salesforce, Microsoft and Google) with finance and asset managers conspicuous by their absence.

Increasingly, there is a perception that finance, including asset management, lacks the all-important ‘cool factor’ that it could plausibly claim before 2008. Moreover, regarding compensation, the tech giants can easily trump the finance sector for the most in-demand knowledge workers.

Tech’s unprecedented growth since the dot.com crash and the reputational damage to banking and asset management from the global financial crisis continue to drive long-term shifts. Given the existential nature of the problem, marketers and recruiters need to harness culture and purpose in their campaigns to attract and retain talent. It is notable how a number of alternative asset managers have sharpened their focus in this respect. Among the managers whose marketing efforts in wooing and retaining talent really shine are Brevan Howard Asset Management, Two Sigma and Citadel.

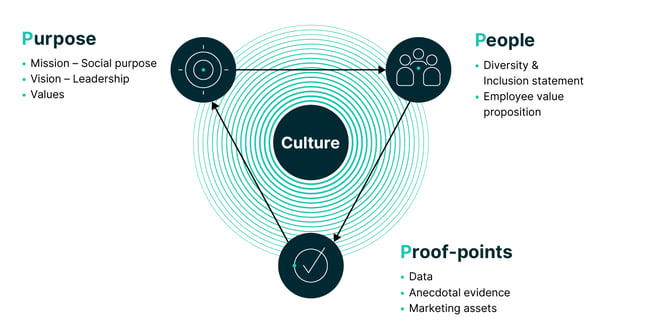

What these firms and others are primarily focused on is purpose. To illustrate this Peregrine has created the 3Ps culture framework. It links purpose, people and proof-points.

Purpose defines why a business exists, how it relates to a broader range of values and why it deserves to exist in the future. It is significant that 90 of the 100 managers in our Global 100 report have publicly facing pages expressing the key points about firm culture, purpose and values.

The challenge for asset management marketing teams is to continue to fuel this narrative and make it authentic with powerful proof-points in investor collateral, the recruitment/culture tabs on a firm’s website and its social media channels.

Conclusion

Despite the challenges marketers and asset managers face, there is a positive story to tell. To do this, some very tangible benefits must be clearly articulated and woven into the industry’s narrative. Among them, we would single out the following:

- Capacity to deliver a positive impact;

- Fostering of meaningful careers;

- Provide investors with diversified returns to secure their financial goals and well-being;

- Offer shareholders competitive business returns.

Building on this will require fresh strategic thinking and more use of data in driving campaigns and insight. This is an imperative given the negative perceptions that have overwhelmed the financial sector – ranging from intermittent scandals to bonuses for failure and, of course, the financial crisis itself.

Covid-19, Brexit and the U.S. election outcome have ushered in a new landscape. This provides a valuable opening to act and thus begin changing the narrative. It is an opportunity that marketing communications leaders are well positioned to seize and we look forward to working with them to do so.

Marketers focused on developing their firms need to be bold, but in a calculated way. Sure, it is often the case that sticking with established programs and approaches is less risky. And let’s face it, the inherent volatility of the current landscape makes advocating and executing business defining change campaigns more tricky.

However, Peregrine’s data driven approach, digital capability and strategic counsel knowhow can help to risk manage campaigns and provide better control over outcomes. In turn, this can be used to demonstrate ROI and to secure C-suite buy-in to continue building firms that deliver an enduring edge, sustainable returns and remain able to go on serving clients and growing.

We want to work with you to help build the asset management industry of tomorrow!