Analysis from Peregrine Communications’ latest ESG Report 2022

Since the outbreak of the Covid-19 pandemic in 2020, interest in Environmental, Social and Governance (ESG) investing has surged, with many asset managers scrambling to communicate around how they manage ESG risks and the positive impact of their investments.

Yet, as we move into 2022 questions have begun to emerge about the validity of ESG investing. Russia’s invasion of Ukraine has raised concerns around Europe’s continued dependence on fossil fuels, whilst the ‘damning’ findings of the latest IPCC report have stirred fresh debate on the impact asset managers are having on the transition to net-zero.

As a result, we may see some managers dialling back their marketing communications efforts in an attempt to avoid getting entangled in negative narratives. But tarring everyone with the same brush would discredit some very positive work being carried out by many managers. It should be hoped that a positive outcome from enhanced scrutiny will be greater attention paid to impact, and more collective understanding of what it means to manage ESG risk in a portfolio.

As we have highlighted in previous editions of our ESG report, asset managers must align their messaging with core capabilities before delivering them via a well-balanced strategic communications program. There remain a number of areas where managers have an opportunity to establish brand differentiation and category authority in a rapidly crowding space. But if their efforts lack authenticity, they not only risk undermining their own reputation but also that of the entire investment industry with negative knock-on economic impacts.

Where can asset managers ‘own the conversation’?

Our whitespace research analysed over 100 different themes to help asset managers identify areas where they can build out differentiated and targeted campaigns within the ESG space.

While certain areas have become increasingly crowded, there remain several themes in 2022 where demand from audiences for content far outstrips supply by asset managers. Our analysis uncovered several areas where certain themes clustered together to form part of a wider trend where well-positioned managers can own the conversation and create genuine category authority.

The Environment

Despite asset managers becoming gradually more sophisticated in their responses to climate change, there remains significant demand for firms to communicate how their commitments and activities relate to nature.

Several firms have partnered with conservation groups and charities over the past year, such as Robeco’s partnership with the World Wildlife Fund for Nature Netherlands, whilst others have committed to frameworks, spurred on by the Taskforce on Nature-related Financial Disclosures (TNFD). However, though these initiatives mark steps in the right direction, the movement to address the natural world is still in its early stages, with our whitespace analysis highlighting significant demand for content on this topic.

Themes including ‘biodiversity’ and ‘deforestation’ continue to remain areas where supply of content is much lower than organic demand from audiences, with ‘nature’, ‘mining’ and ‘recycling’ all significantly ‘under indexed’. The demand for content shows that protecting ‘natural capital’ is an increasingly significant environmental goal which offers managers an opportunity, through thought leadership creation, to differentiate themselves and create category authority.

The Big Picture

As the Covid-19 pandemic raised interest in sustainability and the COP26 summit highlighted action to address the climate crisis, it is unsurprising that our whitespace analysis shows significant demand for content addressing both of these themes.

In the post-pandemic period with climate risks increasingly threatening security, there is a significant demand for insight about concrete strategies that may forestall further crises. With increased public awareness on issues such as climate and sustainability, content focused on resilience should be paramount to managers over the coming years.

Additionally, tangibility continues to be a focus point with our analysis highlighting significant areas of whitespace available around sustainable development, especially with regard to the UN Sustainable Development Goals. Several managers, including Robeco, Schroder’s and Pictet, already outline how strategies and frameworks can contribute to achieving these goals.

Energy Transition vs Energy Crisis

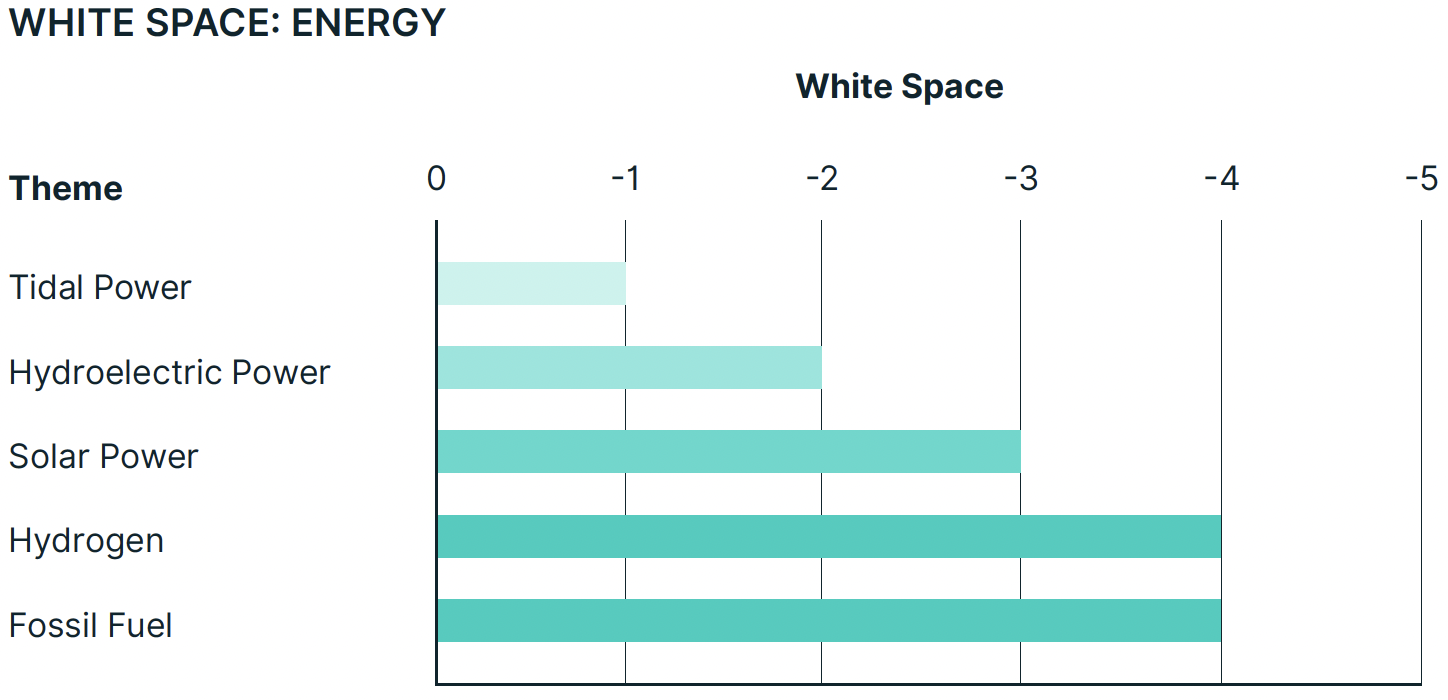

While recent events have led to rising concern over the world's dependence on fossil fuels, our analysis shows that renewable energy solutions are often overlooked, with several themes offering whitespace opportunities.

In particular, there is an increasing opportunity for asset managers to showcase their contribution to the clean energy transition. Our research highlights that more specific content on renewable energy themes is often under indexed, with a particular lack of supply on themes including hydrogen, solar and hydroelectric power. For managers with a clear focus on green and clean energy investments, our findings indicate that these are key areas to promote.

This isn’t to say that demand for content around fossil fuels is abating, particularly given the move by many countries to step up alternative fossil fuel production to relieve dependence on Russian hydrocarbons. Nevertheless, pressure on asset managers to divest from fossil fuel companies is very likely to intensify in the coming years.

Our analysis shows fossil fuels as the most in-demand sub theme within energy transition. Clearly, Russia’s invasion of Ukraine is driving interest, but it is also likely that stakeholders are looking to see whether asset managers are engaging with or divesting from fossil fuels producers. The ranking’s from this year’s ESG report show that managers generated both significant interest from the media and high brand impact scores when they took action in this area.