When we began collecting the data for our second Global 100 Report, we could never have anticipated the year that we were in for, nor could we have expected the stark differences that would emerge between our 2019 and 2020 findings.

Throughout the pandemic, with the majority of firms operating remotely, unable to reach clients and prospects in person, the need for effective social media has been imperative. Investors crave reassurance and open channels of communication. Worryingly, our research has surfaced two disturbing trends, namely, first, that asset managers overall failed to ramp up digital activity, and, second, that many of them overwhelmed investors resulting in 'Covid Content Overload'.

The digital divide

The pandemic highlighted the urgent need to move communications online, and whilst many sectors stepped up to this challenge, it appears asset managers broadly fell short. Indeed, many firms even dialled back their digital activity.

In 2019, 8% of firms assessed scored four or lower on our Social Media metric, but this year that figure ballooned to 36%. This staggering decline in firms using social media effectively represents a significant missed opportunity, one that is likely to impede the momentum of these brands over the coming months and years.

Another concerning trend that emerged from the data was that firms may be suffering from 'Covid Content Overload', whereby audiences are flooded with Covid-related content and, as a result, are less engaged – a similar issue to that of 'Zoom Fatigue'.

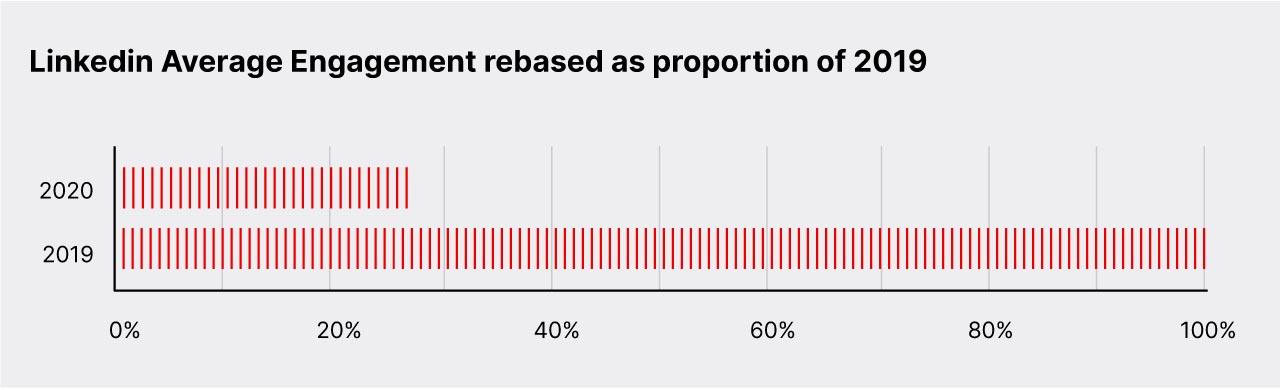

The deterioration, which is evident across multiple social media platforms, is particularly pertinent on LinkedIn, the most popular platform for asset managers. In 2020, the average number of LinkedIn engagements per post stood at only 26% of last year's average.

"Compared to this time last year, the average social media engagement rate is just over a quarter of what it was, which is astonishing," explains Josh Cole, Head of Analytics at Peregrine. "It has fallen off a cliff."

The impact of Covid-19 on businesses is again reflected in the companies' overall scores. Just one in five (18%) of firms achieved an outstanding score of 8 or higher, almost identical to the 2019 data. Although there has not been any improvement to scores, the real stark evidence lies at the other end of the spectrum: as stated previously, 36% of firms scored 4 or less, an increase from 28% the preceding year.

The model examples

Not every asset management firm fell victim to this phenomenon, however. It may come as a surprise that some of the most effective social media we observed in our study came from private equity giants, in particular, Blackstone, Brookfield, and KKR.

With a general decline in average engagement rates across the asset management industry, Brookfield stood out in our data. They managed to grow average LinkedIn engagement by 70% compared with 2019, despite infrequent posting. This reveals an often forgotten truth that quality of content, and giving your audience enough time to absorb it, is more important than consistent updates simply for the sake of ticking off items on your content calendar.

It is Blackstone that emerges at the top of our study, however, being one of only three firms in this year's report to achieve a 10 out of 10 rating for social media. Looking closely at the data, there are a number of areas in which Blackstone excels.

The firm is hugely elevated by its CEO, Stephan Schwarzman, who posts frequently on his own social media, promoting his book, industry views, and philanthropic work. A quasi-content engine in his own right, Schwarzman's huge following on LinkedIn (100,000+) allows him to build his own personal brand while also leveraging the firm.

However, Blackstone's effective social media is not simply down to Schwarzman, he is only part of the greater picture. They truly outshine their competitors with the strong culture content they demonstrate across social media, often supported by compelling videos which demonstrate the firm's unique proposition in terms of its mission, vision, values and employees. The brand image, alongside frequent promotion of the firm's wider philanthropic work with LaunchPad and Techstarts, is why Blackstone had the highest average engagement rate of all the top-scoring firms in our study.

Why social media matters

Historically the asset management industry has been reluctant to enter into the world of social media. However, if there is a case to be made that a robust presence on social media could influence investors and impact your bottom line, it would be wise to take it seriously.

Greenwich Associates recently conducted a study named 'Investing in the Digital Age', in which they interviewed 277 institutional investors between August and November 2018, located in North America, Europe and Asia. The senior investment professionals interviewed discussed their habits and views regarding the use of social media in the investment process and its impact on investment decisions.

The below data points convincingly make the case for asset management firms to be active on social media:

- 86% of investors say they take action on social media content they receive, with 41% doing so at least weekly.

- 63% of institutional investors now consume social media while less than half regularly consume finance-specific trade publications.

- 68% of investors used social media to research asset management firms in 2018, up from 36% in 2015.

- Institutional investors rated LinkedIn as the second best and Twitter as the fourth best media sources for deep subject matter education beating the WSJ, CNBC, Business Insider and The New York Times. This is due to the fact that asset managers post thought leadership, online/digital reports, infographics, videos and podcasts.

How to get ahead

While the results of our Global 100 report have surfaced worrying trends, the data has also, in turn, allowed us to pinpoint the best practices on social media. Looking at the behaviours exhibited by the best performing firms on LinkedIn, Twitter and YouTube, this is what we believe will set asset management firms apart from the rest.

As LinkedIn becomes an informative tool for institutional investors, it is ever more critical that firms utilise regular video content to promote brand values, product and strategy information, as well as employ 'hero content' to boost campaigns. When it comes to branding, our data has shown that those with effective social media content rely heavily on consistent branding to create a positive impression of the firm.

Events in 2020 and the Global 100 report demonstrate the need for effective social media what asset managers need to focus on. As Josh Cole, Head of Analytics explains, it is "not necessarily volume, but high-quality content, powerful, impactful things that are really going to cut through and resonate with audiences."

For more recommendations, please see our Global 100 report.